unified estate and gift tax credit 2021

In your case gifts of 35000 would generate a gift tax of 5100 using 2018 figures. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF.

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

It is a transfer tax not an income tax.

. January 1 2020. The regulations implement changes made by the. Ordinary monetary and property gifts are.

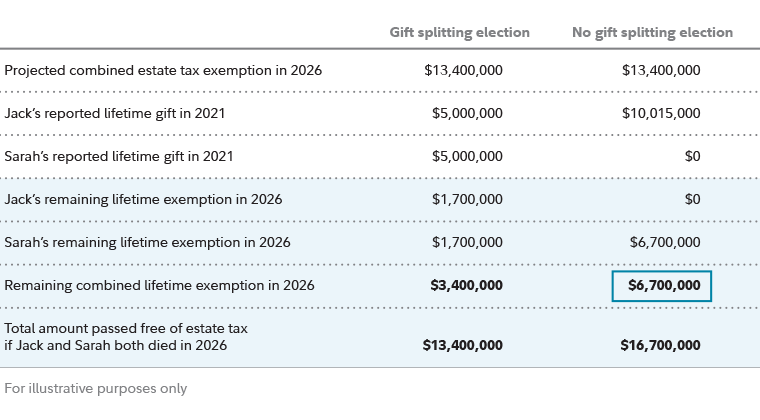

The federal estate tax exemption is transferable between spouses meaning that if the second spouse in a married couple dies in 2022 their estate can effectively have a 24. Credit Shelter Trust - CST. This credit allows each person to gift a certain amount of their assets to other parties.

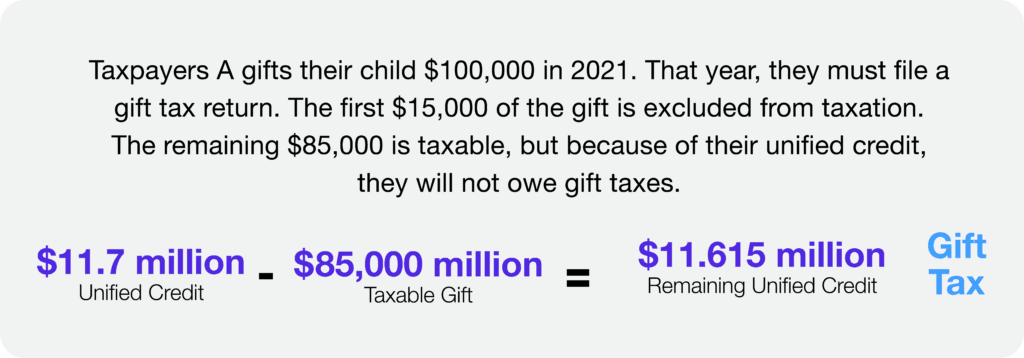

In the case of estate and gift taxes the unified tax credit provides a set amount that any individual can gift during their lifetime before any of these two taxes apply. Made during the three year period that ends on the decedents date of death and. Your tax liability for 2018 would be 0.

The cap amount is 1206 million in 2022 up from 117 million in 2021. For 2018 the unified credit is 4417800 which represents the would be gift tax on the 2018 exclusion amount of 1118M. In the case of real estate payments to someone elses mortgage is going to fall under the gift tax when exceeding 15000.

However you can apply your unified tax credit to offset the tax on paying someone elses mortgage. A gift tax is a type of transfer tax that is imposed when someone gives something of value to someone else. States that score well on the corporate tax base subindex generally will have few business tax credits generous carryback and.

Using the student debt example writing a check to the relative is considered a gift while paying the college directly is not. 2021 through December 31 2021. For example lets say you give away 506 million in assets during your lifetime.

Under 2503 of the Internal Revenue Code IRC the estate must add back any taxable gift. A type of trust that allows a married investor to avoid estate taxes when passing assets on to heirs. In economics a gift tax is the tax on money or property that one living person or corporate entity gives to another.

In short a person would have to gift more than 12060000 before he would ever pay gift tax. Including estate inheritance and gift taxes. The estate of a New York State resident must file a New York State estate tax return if the following.

The IRS formally made this clarification in proposed regulations released that day. The federal estate tax kicks in for estates that are worth more than 117 million in 2021 and 1206 million in 2022 the same amounts as the lifetime gift tax exemption. The gift tax imposes a tax on large gifts preventing large transfers of wealth without any tax implications.

The Estate Tax is a tax on your right to transfer property at your death. Unified Tax Credit. A tax credit that is afforded to every man woman and child in America by the IRS.

So if you gave 3 million worth of. Youd have just. The tax is a unified tax.

Your unified tax credit as described above will offset this amount. Therefore this edition is the 2021 Index and represents the tax climate of each state as of July 1 2020 the first day of fiscal year 2021. The trust is structured so that upon the death of the investor.

The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. Keep in mind that the annual exclusion applies per individual which means you can gift significantly more than 15000 per year so long as its given to multiple people or organizations. For example if you gift someone 20000 in 2021 you will have to file a gift tax return for 5000 which is the amount over the annual exclusion.

The transfer must be gratuitous or the receiving party must pay a lesser amount than the items full value to be considered a gift. Certain gifts that you make during your lifetime reduce the amount your estate can pass free of estate tax. Most every American taxpayer receives a lifetime credit against federal gift and estate tax of 12060000.

The same rules apply to estate taxes but the 117 million estate tax exemption for 2021 is reduced by the value of the gifts you give throughout your lifetime. 20 2018 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels.

Exploring The Estate Tax Part 2 Journal Of Accountancy

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Talk To Clients About Estate Taxes Lifetime Gifts Corvee

U S Estate Tax For Canadians Manulife Investment Management

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

U S Estate Tax For Canadians Manulife Investment Management

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Estate Planning Strategies For Gift Splitting Fidelity

A Taxing Matter For Family Businesses Mercer Capital

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Estate Tax Fair Market Value Of Gross Estate Corporate Income Tax Cpa Exam Regulation Youtube

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition